Profile

Who: Kimball Corson. Text and Photos not disclaimed or that are obviously not mine are copyright (c) Kimball Corson 2004-2016

Port: Lake Pleasant, AZ

Altaira Wandering the Oceans

Favorites

- 7 Seas Cruising Association

- American Sailing Association

- Buoyweather Service

- CDC Traveler's Heath Advisories

- Cruiser Log venue

- Cruisers Forum

- Cruising Club of America

- Cruising Resources

- Cruising World Magazine

- Earthrace World Record

- Economic and Financial Indicators

- Economist Magazine

- Equipmment and Boat Reviews

- Float Plan Form

- Greenpeace Int'l

- Grib File Access

- Heavy Weather Sailing

- IMS Certificates

- Inland Travel: Expedia

- Intrade Prediction Markets

- Latitude 38

- London Financial Times

- Marine Books and Charts

- Marine Radios

- Nature Conservancy for Oceans

- New York Times

- NOAA Hurricane Analysis

- NOAA Weather Forecasts

- Noonsite, World Cruisng Info

- Ocean Cruising Club

- Overseas Mail Forwarding Services

- Practical Sailor Magazine

- RGE Economic Monitor

- Sail Gear Source I

- Sail Gear Source II

- Sail Gear Source III

- Sail Gear Source IV

- Sailboat Selection for Offshore Use

- Sailboats for Sale

- Sailing Items Sources Links

- SailMail (Marine Radio)

- Sailnet Sailing Information

- Seeking Alpha

- Tide & Current Program

- Tide Prediction Programs

- Tides & Currents

- TruthDig in the News

- U.S. Sailing Association

- Univ of Chicago Law Faculty Blog

- US State Dept Travel Advisories

- Voyage Planning (with pilot charts)

- Wall Street Journal

- Washington Post

- Weather.com

- Weather: MagicSeaweed

- Weather: Wetsand

- WinLink (Ham Radio)

- World Clock + Time Zones

09 April 2018 | Pago Pago, American Samoa

10 March 2018 | Pago Pago, American Samoa

10 March 2018 | Pago Pago, American Samoa

10 March 2018 | Pago Pago, American Samoa

22 August 2017 | Pago Pago, American Samoa

22 August 2017 | Pago Pago, American Samoa

22 August 2017 | Pago Pago, American Samoa

22 August 2017 | Pago Pago, American Samoa

22 August 2017 | Pago Pago, American Samoa

22 August 2017 | Pago Pago, American Samoa

22 August 2017 | Pago Pago, American Samoa

22 August 2017 | Pago Pago, American Samoa

22 August 2017 | Pago Pago, American Samoa

22 August 2017 | Pago Pago, American Samoa

22 August 2017 | Pago Pago, American Samoa

22 August 2017 | Pago Pago, American Samoa

22 August 2017 | Pago Pago, American Samoa

22 August 2017 | Pago Pago, American Samoa

22 August 2017 | Pago Pago, American Samoa

09 August 2017 | Pago Pago, American Samoa

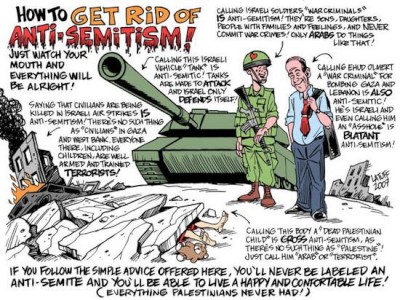

On Anti-Semitism

15 June 2013 | Pago Pago, American Samoa

Kimball Corson

On the Charge of Anti-Semitism

Don't I know it. The charge of antisemitism is a ruse to shut you up when you say something Jews don't want to hear. I have been there a thousand times. Failing with a charge of antisemitism and other efforts, and realizing I can't be muzzled, I have next usually heard the door of friendship slam closed with a "Fuck you, Corson" or words to that effect.

Christianity has a tradition of forgiveness that Judaism more fundamentally lacks. I have subsequently learned much about that, too. Like infidels to Islam, Goyim to Judaism lack preferred status and less is to be tolerated from and forgiven them. They can easily say too much, which tolerated from a Jew, is not to be tolerated from them.

Don't I know it. The charge of antisemitism is a ruse to shut you up when you say something Jews don't want to hear. I have been there a thousand times. Failing with a charge of antisemitism and other efforts, and realizing I can't be muzzled, I have next usually heard the door of friendship slam closed with a "Fuck you, Corson" or words to that effect.

Christianity has a tradition of forgiveness that Judaism more fundamentally lacks. I have subsequently learned much about that, too. Like infidels to Islam, Goyim to Judaism lack preferred status and less is to be tolerated from and forgiven them. They can easily say too much, which tolerated from a Jew, is not to be tolerated from them.

Comments

| Vessel Name: | Altaira |

| Vessel Make/Model: | A Fair Weather Mariner 39 is a fast (PHRF 132), heavily ballasted (43%), high-aspect (6:1), stiff, comfortable, offshore performance cruiser by Bob Perry that goes to wind well (30 deg w/ good headway) and is also good up and down the Beaufort scale. |

| Hailing Port: | Lake Pleasant, AZ |

| Crew: | Kimball Corson. Text and Photos not disclaimed or that are obviously not mine are copyright (c) Kimball Corson 2004-2016 |

| About: | |

| Extra: |

Altaira's Photos - Main

No items in this gallery.

Profile

Who: Kimball Corson. Text and Photos not disclaimed or that are obviously not mine are copyright (c) Kimball Corson 2004-2016

Port: Lake Pleasant, AZ

Altaira Wandering the Oceans

Favorites

- 7 Seas Cruising Association

- American Sailing Association

- Buoyweather Service

- CDC Traveler's Heath Advisories

- Cruiser Log venue

- Cruisers Forum

- Cruising Club of America

- Cruising Resources

- Cruising World Magazine

- Earthrace World Record

- Economic and Financial Indicators

- Economist Magazine

- Equipmment and Boat Reviews

- Float Plan Form

- Greenpeace Int'l

- Grib File Access

- Heavy Weather Sailing

- IMS Certificates

- Inland Travel: Expedia

- Intrade Prediction Markets

- Latitude 38

- London Financial Times

- Marine Books and Charts

- Marine Radios

- Nature Conservancy for Oceans

- New York Times

- NOAA Hurricane Analysis

- NOAA Weather Forecasts

- Noonsite, World Cruisng Info

- Ocean Cruising Club

- Overseas Mail Forwarding Services

- Practical Sailor Magazine

- RGE Economic Monitor

- Sail Gear Source I

- Sail Gear Source II

- Sail Gear Source III

- Sail Gear Source IV

- Sailboat Selection for Offshore Use

- Sailboats for Sale

- Sailing Items Sources Links

- SailMail (Marine Radio)

- Sailnet Sailing Information

- Seeking Alpha

- Tide & Current Program

- Tide Prediction Programs

- Tides & Currents

- TruthDig in the News

- U.S. Sailing Association

- Univ of Chicago Law Faculty Blog

- US State Dept Travel Advisories

- Voyage Planning (with pilot charts)

- Wall Street Journal

- Washington Post

- Weather.com

- Weather: MagicSeaweed

- Weather: Wetsand

- WinLink (Ham Radio)

- World Clock + Time Zones